- Joined

- Mar 7, 2019

- Messages

- 1

- Reaction score

- 0

- Country

Hello,

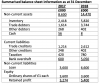

I'm currently working on a problem that requires me to figure out the cash flow statement using the indirect method.

However, I'm not sure what to do with bank overdraft and how to figure out the end cash&cash equivalent value.

So, here, I calculated as following:

So, here, I didn't take the bank overdraft into financing activity. But, should I? If so, how would it affect the final cash&cash equivalent value (debit or credit)?

Please help the confused guy... Thank you.

I'm currently working on a problem that requires me to figure out the cash flow statement using the indirect method.

However, I'm not sure what to do with bank overdraft and how to figure out the end cash&cash equivalent value.

So, here, I calculated as following:

- Net Cash flows from Operating Activities: 1152

- Net Cash flows from Investing Activities: 8670

- Net Cash flows from Financing Activities: 3000

- Net Decrease in Cash: 4518

So, here, I didn't take the bank overdraft into financing activity. But, should I? If so, how would it affect the final cash&cash equivalent value (debit or credit)?

Please help the confused guy... Thank you.

Attachments

-

107.9 KB Views: 4,565