Hi all. How do I key in the journey for the following in the journal entry

On 18 December, a customer paid the company a deposit of $830 for an item to be delivered in Jan 20X9. The account clerk recorded the $830 as a debit to cash and a $830 credit to revenue.

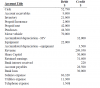

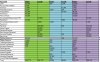

The list of account I have is attached to the post below. Also if i were to an adjusting on my trial balance am I able to add on "insurance expenses" under the account?

On 18 December, a customer paid the company a deposit of $830 for an item to be delivered in Jan 20X9. The account clerk recorded the $830 as a debit to cash and a $830 credit to revenue.

The list of account I have is attached to the post below. Also if i were to an adjusting on my trial balance am I able to add on "insurance expenses" under the account?

Last edited: