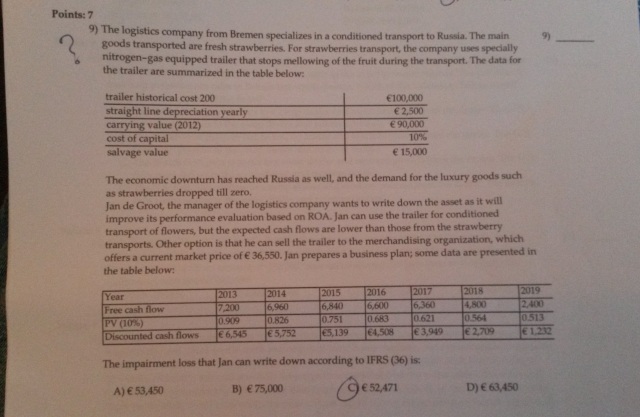

Could you please give some details on the actual calculation of the impairment loss (i.e. what I need to substract from what)?

Value in use :

2013: free cash flow €7,200 ; PV (10%) 0.909 ; disc. cash fl. €6,545

2014: free cash flow €6,960 ; PV (10%) 0.826 ; disc. cash fl. €5,752

2015: free cash flow €6,840 ; PV (10%) 0.751 ; disc. cash fl. €5,139

2016: free cash flow €6,600 ; PV (10%) 0.683 ; disc. cash fl. €4,508

2017: free cash flow €6,360 ; PV (10%) 0.621 ; disc. cash fl. €3,949

2018: free cash flow €4,800 ; PV (10%) 0.564 ; disc. cash fl. €2,709

2019: free cash flow €2,400 ; PV (10%) 0.513 ; disc. cash fl. €1,232

2019: salvage value €15,000; PV (10%) 0.513 ; disc. cash fl. €7,695

Total disc. cash fl = €37,529 (value in use)

Recoverable amount is the higher of an asset's fair value less costs of disposal* (sometimes called net selling price) and its value in use

Since the value in use is higher than the selling price €36,550. So the recoverable amount

of the Trailer is €37,529

The impairment loss = Carrying value - Recoverable amount

= €90,000 - €37,529

= €52,471