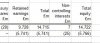

Example – Tesco’s Equity or Shareholders funds has reduced from 14722 to 7071. The main reason for this can be seen in the Statement of changes in equity –

The bulk being the loss for the year of 5 billion. My question is, is this a good example of how a loss would normally be accounted by being deducted from retained earnings, thus reducing the equity account?

The bulk being the loss for the year of 5 billion. My question is, is this a good example of how a loss would normally be accounted by being deducted from retained earnings, thus reducing the equity account?