- Joined

- Mar 22, 2018

- Messages

- 1

- Reaction score

- 1

- Country

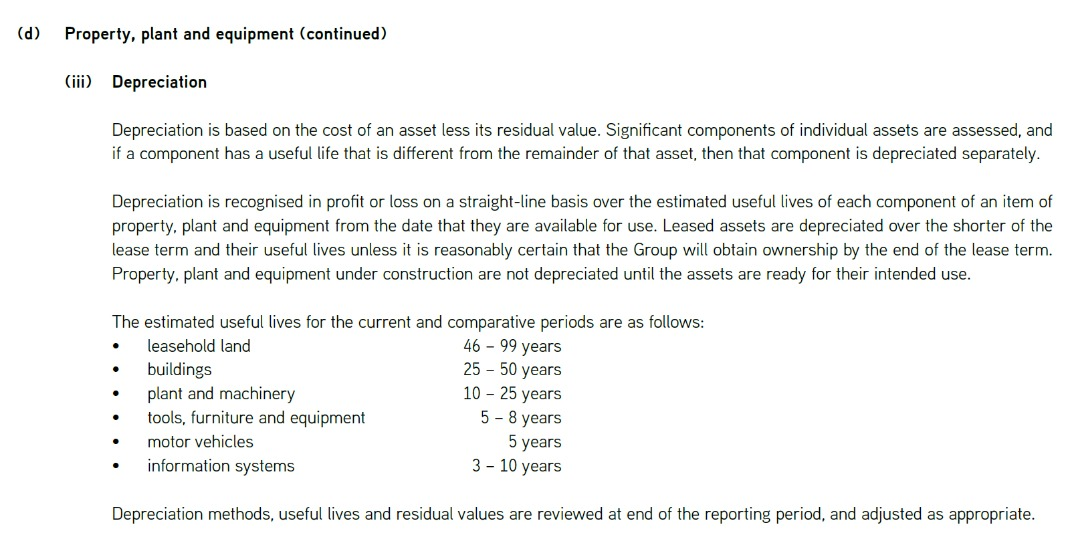

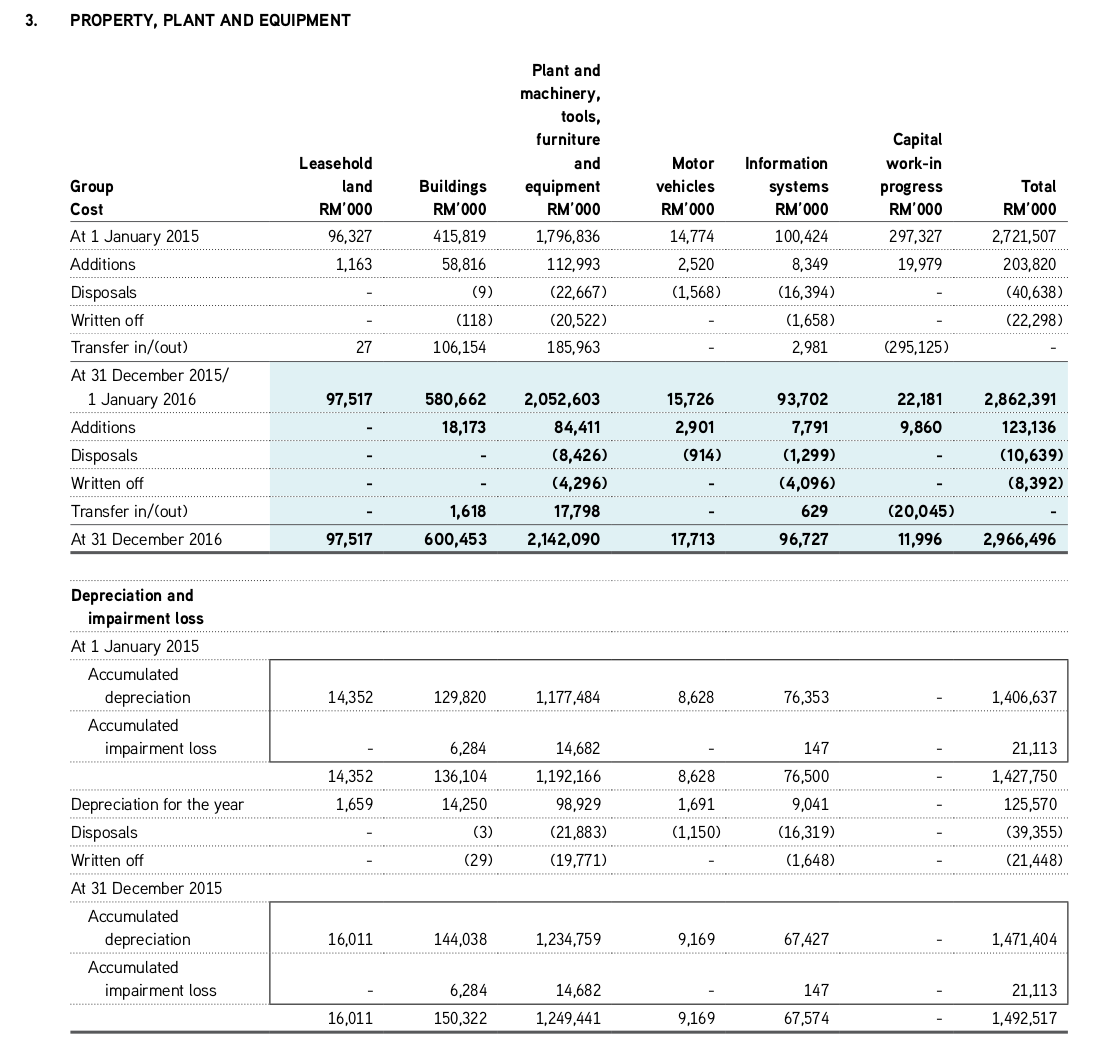

How should I calculate the depreciation of each type of fixed assets when we have disposals, written off and transfer in/out ?

I suppose straight line method could be used here , or I am wrong ?

Besides, does impairment loss affect the calculation for depreciation rate ?

I suppose straight line method could be used here , or I am wrong ?

Besides, does impairment loss affect the calculation for depreciation rate ?

Attachments

-

169.3 KB Views: 495

Last edited: