- Joined

- Jun 30, 2017

- Messages

- 6

- Reaction score

- 0

- Country

Hi,

My question is regarding accounting for the new lease ASC 842 rule for a 5 year lease that has escalating payments with payments due monthly.

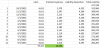

I calculated the present value of the lease and ROU, but I can't figure out how to amortize it on a monthly basis. Below is my lease with escalating payments (1.5%) every year. When I perform the amortization schedule on a yearly basis, using a 9% interest rate, I get the following clean looking schedule that amortizes down to zero.

When I try to break it out by month with the same interest rate of 9% and same cash payment in total I'm not getting my total lease liability expense (interest) to be equal to my yearly. Below, you can see for my first month I'm showing $26,394 vs. above $28,542 which is making it impossible to amortize my lease liability to zero the way I have when I look at it yearly.

What am I doing wrong here? Is there some time value of money I'm not taking in to effect here?

If there is a solution can you point me to the specific language (or equivalent) that addresses this specific issue so I can communicate it to folks who are not in the accounting world more smoothly?

Thank you,

My question is regarding accounting for the new lease ASC 842 rule for a 5 year lease that has escalating payments with payments due monthly.

I calculated the present value of the lease and ROU, but I can't figure out how to amortize it on a monthly basis. Below is my lease with escalating payments (1.5%) every year. When I perform the amortization schedule on a yearly basis, using a 9% interest rate, I get the following clean looking schedule that amortizes down to zero.

When I try to break it out by month with the same interest rate of 9% and same cash payment in total I'm not getting my total lease liability expense (interest) to be equal to my yearly. Below, you can see for my first month I'm showing $26,394 vs. above $28,542 which is making it impossible to amortize my lease liability to zero the way I have when I look at it yearly.

What am I doing wrong here? Is there some time value of money I'm not taking in to effect here?

If there is a solution can you point me to the specific language (or equivalent) that addresses this specific issue so I can communicate it to folks who are not in the accounting world more smoothly?

Thank you,

Attachments

-

19.9 KB Views: 13