- Joined

- Nov 5, 2015

- Messages

- 1

- Reaction score

- 0

- Country

Hi guys,

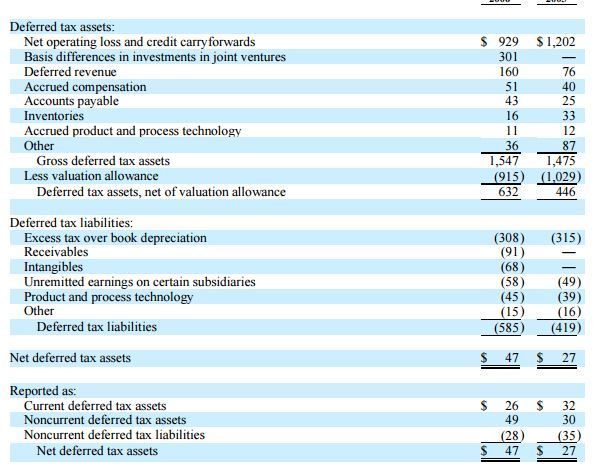

I'm studying Income Taxes reporting, and I'm trying to make sense of the following excerpt from the financial statements of a company

My question may sound basic for everybody here but, looking at the line "Deferred Tax Liabilities" it says that the value for the last year is M$ 585. Why then it says later in the line "Noncurrent deferred tax liabilities" that the deferred tax liabilities are M$ 28?

I don't understand how it takes a net deferred tax asset of M$ 47 and then it break it into pieces of current and non current DTA and DTL to place it like that into the balance sheet.

Thanks.

I'm studying Income Taxes reporting, and I'm trying to make sense of the following excerpt from the financial statements of a company

My question may sound basic for everybody here but, looking at the line "Deferred Tax Liabilities" it says that the value for the last year is M$ 585. Why then it says later in the line "Noncurrent deferred tax liabilities" that the deferred tax liabilities are M$ 28?

I don't understand how it takes a net deferred tax asset of M$ 47 and then it break it into pieces of current and non current DTA and DTL to place it like that into the balance sheet.

Thanks.