What are the actual formulas for SL, DB, and DDB? I've seen it a bunch of different ways in various blogs and financial magazine sites. Nothing but SL ever seems to make sense.

Closed-form formulas aren't as important as understanding the process for calculating the depreciation expense for each year. (This is why we have calculators and spreadsheets.)

Straight-line is obvious. The depreciable amount is cost less salvage value. If an asset's useful life is n years, depreciation expense is 1/n * (cost less salvage value) per year for n years. Easy peasy. Simple linear function; same amount of depreciation each year.

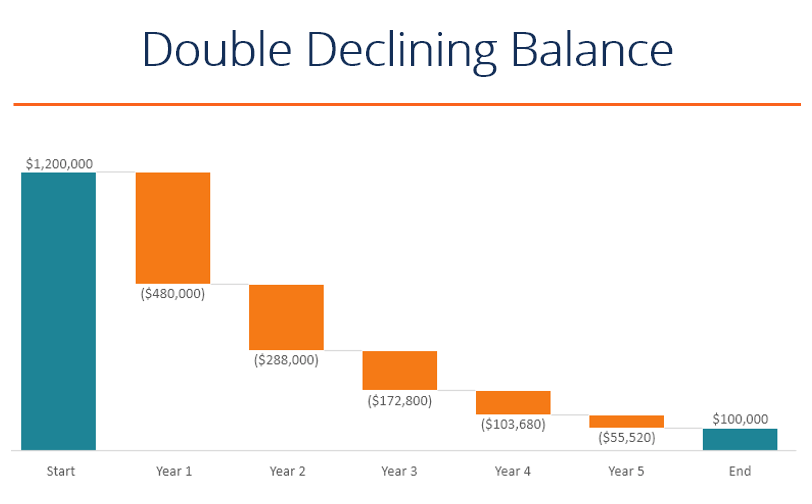

Double declining balance: Start with the same depreciable amount. If the useful life is again n years, you depreciate 2/n of the remaining depreciable amount each year, with a floor at zero. So the depreciable amount left after k years will be initial depreciable amount * (1 - 2/n)^k, where k = 1, 2,..., n - 1. Year n's depreciation expense is whatever depreciable value is left at the end of year n -1/start of year n, since that's the end of the asset's useful life. Not as easy, and a bit less peasy. The

rate of depreciation is constant (up till the final year), but the

amount of depreciation declines each year as the depreciable amount amortizes. The link below has a really clear example that walks you through the calculation, if that helps.

And 100k% declining balance is a generalization of double declining balance. The depreciation rate is k/n instead of 2/n, but the algorithm is otherwise the same.

The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular depreciation approach. It is

corporatefinanceinstitute.com