Hi. Seeing as how nobody has answered your question as of yet, I'll do my best to answer the question myself (I'm currently a college student, however, I've taken tax courses and am currently in the VITA program for my class "Applied Income Taxes". Besides, your question isn't too complicated

).

First of all, the rules for declaring child care expenses.

Rule 1: Your child must be a "qualifying person".

Essentially, the boundaries of this rule are that the qualifying person must be related to you, then you (or your spouse) must provide more than 50% of the income that supports the person, and finally, the person must live with you for more than 50% of the year. With that being said, I say that we can "check off" rule one as it seems that your child is obviously a qualifying person.

Rule 2: You (or your spouse) must have earned income during the year.

Obviously you can't deduct things from your taxes if you didn't make any money or you don't have any taxes to pay.

Rule 3:

Rule 3: Your expenses must have been paid to allow you (or your spouse) to work while your child was being cared for.

This includes actively looking for work or attending college full-time.

Rule 4: You must make payments for child and dependent care to someone you (and your spouse) can't claim as a dependent.

Essentially, you can't pay your child's older brother to watch him and then claim the payment as a child care expense. Same goes for Grandma or Grandpa if either of them can be claimed as a dependent.

Rule 5: If you are married, you must claim the credit on a joint return unless exemptions apply

Essentially, "Rule 5" deals mainly with a tax situation were you could be separated, but still be considered "legally married". In this case, it's possible to claim the credit on a "married filing separately" return.

Rule 6: You must identify the provider on your tax return.

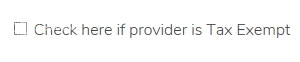

This includes the providers name, address, and taxpayer identification number. Usually this information goes on Form 2441; however, if you're using tax software (as you stated you were), then the form should be auto-generated when you fill out the information in H&R Block. If the provider is tax exempt (as you had mentioned that the YMCA is), then normally you would just write the words "Tax-Exempt" in the space where the form normally asks for the taxpayer identification number (providing you were doing your taxes with pencil and paper). However, with tax software, you usually leave the box blank and check the box that states the provider is tax exempt. In TaxSlayer Pro, it looks like this:

Rule 7: You

MUST deduct any employer provided assistance to your child's care expenses.

For example, if your employer pays $1,000 to help with child care expenses (such as under a benefits plan), then this total must be deducted from the credit (usually, there will be a blank space to add "Employer Assistance" in your tax software).

All right, now that we know the rules, on to the second step which is figuring out the credit. As far as actually figuring out the credit goes, the entire process should be completely automated by your tax software. Usually, you just "fill-in-the-blanks", and once they are filled in, your tax software will do the actual calculation. No need to dust off your calculator. The credit itself is usually located under some sort of "Credits Menu" (again, I've never used H&R Block's software, so I don't specifically know for sure where it is; but it shouldn't be too hard to find). The credit then goes on Line 49 if it's a 1040, or Line 31 if it's a 1040A (your tax software should automatically place the credit on the correct line). Finally, Form 2441 then gets attached to your return (again, your tax software should do this automatically).

And that should conclude the Child Care Expenses Credit. If you want me to go deeper, I can show you the actual math; but other than that the software should calculate it automatically. Hopefully my post wasn't too confusing. Let me know if I helped!