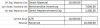

Inventory on books for$7,000 (7 units at $1,000). Need to sale/invoice client 4 units at $1,050 ($4,200). I understand that the transactions typically would be: 1) debit COGS $4,000 & credit inventory $4,000, 2) debit Sales $4,200 & credit A/R $4,200. The gross profit therefore is $200.

However, I believe I need the $4,200 to be reflected on my books as an direct expense. So that it can be passed onto the client via an invoice (sales journal posting will debit sales and credit A/R the $4,200) My sales journal is a total direct costs and overhead burden costs.

How do I record the 4,200 in direct expenses?

However, I believe I need the $4,200 to be reflected on my books as an direct expense. So that it can be passed onto the client via an invoice (sales journal posting will debit sales and credit A/R the $4,200) My sales journal is a total direct costs and overhead burden costs.

How do I record the 4,200 in direct expenses?