Hi,

This has been bugging me for weeks. To do with recording Provision for depreciation in the financial statements.

Easier to use an example to explain (will use for simplicity, financial period from January to December)

So, a machine depreciates at $250 per year (straight line method).

Brought beginning of 2016.

At the end of 2016 depreciation will be $250.

End of 2017 depreciation will be $250 (b/d) + $250.

End of 2018 depreciation will be $500 (b/d) + $250.

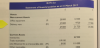

Trial balance at the end of 2018 (depreciation section) would show $750 (accumulated depreciation).

Income statement at end of 2018 (depreciation section) shows $250 (for the year only).

Now that all make sense, since start off 2016 up until the end of 2018 the total depreciation for that machine has been $750, this is shown on the 31.12.2018 Trial Balance, whereas $250 is shown on the Income statement (31.12.2018), as it is only for that accountancy period.

Here where it confuses the life out of me, if the depreciation part of the Statement of financial position, for the end of 2018, shows $750, that would make perfect sense. That you have a machine that say cost $2800, it now has lost $750 in depreciation, therefore asset value up until end of 2018 is $2050.

But the Statement of financial position for end of 2018 shows not only the trial balance (the accumulated depreciation) but the depreciation value on the income statement $250. So instead of deducting $750 from the assist, we are now deducting $1000.

Surely this $250 in the income statement is already accounted for in the accumulated depreciation value (in the $750 found in the the trial balance)?

So why are we now adding 2018 depreciation back onto the accumulated value. It is almost like we are counting 2018 depreciation value twice when doing the Statement of financial position. Or that we are taking the accumulated depreciation value up until 31.12.2018 (Trial balance value of $750), and then for some reason adding another year (depreciation for 2019) depreciation onto it (another $250).

Could understand if Statement of financial position is for the end of 2019 but it is not, it is for same reporting year.

Any help be greatly appreciated.

To recap - why does the Statement of financial position regarding the depreciation section, not simple show the accumulated depreciation value, as represented by the Trial balance value.

Thanks, John

This has been bugging me for weeks. To do with recording Provision for depreciation in the financial statements.

Easier to use an example to explain (will use for simplicity, financial period from January to December)

So, a machine depreciates at $250 per year (straight line method).

Brought beginning of 2016.

At the end of 2016 depreciation will be $250.

End of 2017 depreciation will be $250 (b/d) + $250.

End of 2018 depreciation will be $500 (b/d) + $250.

Trial balance at the end of 2018 (depreciation section) would show $750 (accumulated depreciation).

Income statement at end of 2018 (depreciation section) shows $250 (for the year only).

Now that all make sense, since start off 2016 up until the end of 2018 the total depreciation for that machine has been $750, this is shown on the 31.12.2018 Trial Balance, whereas $250 is shown on the Income statement (31.12.2018), as it is only for that accountancy period.

Here where it confuses the life out of me, if the depreciation part of the Statement of financial position, for the end of 2018, shows $750, that would make perfect sense. That you have a machine that say cost $2800, it now has lost $750 in depreciation, therefore asset value up until end of 2018 is $2050.

But the Statement of financial position for end of 2018 shows not only the trial balance (the accumulated depreciation) but the depreciation value on the income statement $250. So instead of deducting $750 from the assist, we are now deducting $1000.

Surely this $250 in the income statement is already accounted for in the accumulated depreciation value (in the $750 found in the the trial balance)?

So why are we now adding 2018 depreciation back onto the accumulated value. It is almost like we are counting 2018 depreciation value twice when doing the Statement of financial position. Or that we are taking the accumulated depreciation value up until 31.12.2018 (Trial balance value of $750), and then for some reason adding another year (depreciation for 2019) depreciation onto it (another $250).

Could understand if Statement of financial position is for the end of 2019 but it is not, it is for same reporting year.

Any help be greatly appreciated.

To recap - why does the Statement of financial position regarding the depreciation section, not simple show the accumulated depreciation value, as represented by the Trial balance value.

Thanks, John